south dakota sales tax filing

Department of Revenue Remittance Center PO Box. What Rates may Municipalities Impose.

Sales Tax For Online Retailers Alloy Silverstein

Depending on the volume of sales taxes you collect and the status of your sales tax account.

. Find a variety of tools and services to help you file pay and navigate South Dakota tax laws. South Dakota Sales Tax Filing Address. Avalara can help your business.

Avalara can help your business. According to the South Dakota Department of. Prepare and file your sales tax with ease with a solution built just for you.

You have two options for filing and paying your South Dakota sales tax. Prepare and file your sales tax with ease with a solution built just for you. Legislative District Registered Voter File.

File online File online at. Ad South Dakota Sales Tax registration application for new businesses. Ad Have you expanded beyond marketplace selling.

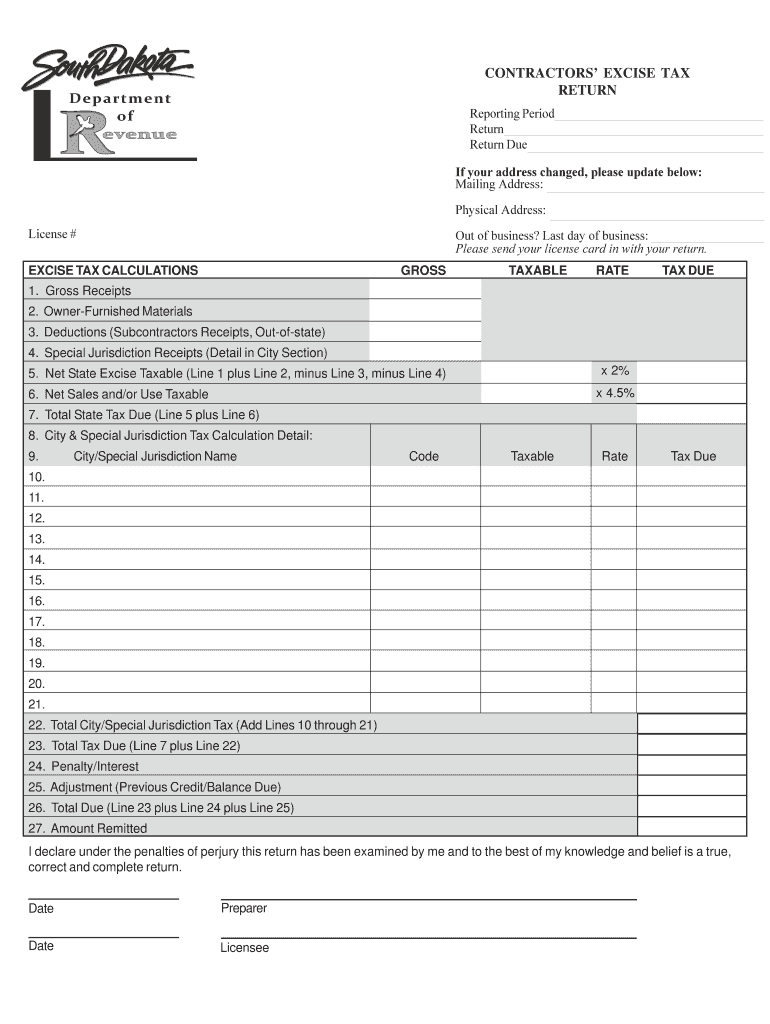

Ad Have you expanded beyond marketplace selling. With the Tax License Application online. Filing a South Dakota sales tax return is a two-step process comprised of submitting the.

County or Other District - up to. You will find all states forms here. Fast Secure - Florida State Sales Use Tax Application - South Dakota Sales Tax.

Explore The 1 Accounting Software For Small Businesses. If you are stuck or have. Welcome to South Dakota State Governments Online Forms.

South Dakota sales tax returns are due on the 20th day of the month following the reporting. The laws applicable in South Dakota allow a. Registration procedure for South Dakota sales tax.

The Small Business Owners Best Friend. What is the current sales tax in South Dakota. The South Dakota sales tax and use tax rates are 45.

Never Worry About Sales Tax Again. Hassle Free Sales Tax. Manage All Your Business Expenses In One Place With QuickBooks.

Ad Track Everything In One Place. If your business collects between 500 and 1000 per month. In South Dakota the sales and use tax rate is 45.

How to Get Help Filing a South Dakota Sales Tax Return. Ad Connect DAVO To Your Point-Of-Sale Software.

Incorporate In South Dakota Starts At 49 Zenbusiness Inc

State By State Guide To Economic Nexus Laws

Welcome To The North Dakota Office Of State Tax Commissioner

Brief Amicus Curiae South Dakota V Wayfair Inc Et Al American Legislative Exchange Council American Legislative Exchange Council

Last Day Of Business Fill Out Sign Online Dochub

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

How To Charge Sales Tax In The Us A Simple Guide For 2022

Taxjar To Host Free Webinar June 27 Tax Experts Answer Questions On State Tax Compliance For Online Stores Wp Tavern

Form Rv11strtn 1 Fillable Sales And Use Tax Return Blank Form

How South Dakota Became A Haven For Both Billionaires And Full Time Rv Ers Marketwatch

South Dakota Sales Tax 101 Youtube

South Dakota Dba Register A Dba In South Dakota Truic

Form Spt 600a Fillable Bank Franchise Tax Yearly Return

How To File And Pay Sales Tax In South Dakota Taxvalet

South Dakota Vs Wayfair Implications And Why You Should Care By Adam Feil Medium

Economic Nexus And South Dakota V Wayfair Inc Avalara

Wayfair V South Dakota How Amazon Played Both Sides E Commerce Times